With inflation surging globally, investors are increasingly seeking safe havens. Bitcoin, the world's first and most well-known copyright, has often been marketed as a potential hedge against escalating prices. Its decentralized nature and limited supply have led some to posit that it could flourish in an inflationary environment. However, the relationship between Bitcoin and inflation is complex and ambiguous. While some historical data suggests a correlation, it's important to note that Bitcoin is a relatively recent asset class, and its long-term performance persists check here to be seen.

Dollar Devaluation: How Bitcoin Stacks Up Against Inflation

As the value of the US currency continues to fluctuate, investors are increasingly turning to alternative assets that can mitigate inflation. One such asset gaining traction is Bitcoin, a decentralized copyright known for its limited supply and impervious nature to traditional monetary policies. While the historical correlation between Bitcoin and inflation is complex, some proponents argue that Bitcoin's fundamental properties make it a potential inflation hedge.

- Despite this, critics point to Bitcoin's volatility as a major concern for investors seeking a reliable inflation shield.

- Therefore, the question of whether Bitcoin can effectively counteract dollar devaluation remains an open debate with valid arguments on both sides.

Analyzing Bitcoin's Historical Performance Against Inflation Charts

Bitcoin presents itself a digital asset that continues to attract significant attention in recent years. Its fluctuating nature, coupled with its potential for gains, makes it an attractive investment for some. However, Bitcoin's historical performance against inflation serves as a subject of analysis. Charts depict the complex relationship between Bitcoin's worth and inflation rates, providing insights into how Bitcoin may function as a potential hedge against inflation.

- A multitude of charts display the historical relationship between Bitcoin and inflation, exposing periods of both similarity and separation.

- Researchers often harness these charts to evaluate Bitcoin's potential as a safe-haven asset during times of economic turmoil.

- Chart patterns presented in these charts can be valuable information for investors who seek to understand the implications of investing in Bitcoin as a hedge against inflation.

Can Bitcoin a Hedge Against Rising Prices?

When prices are increasing, investors often look for safe havens. Bitcoin, the first copyright, has been positioned as a potential safeguard against mounting prices. However, its ability to consistently serve this function is debated. Some argue that Bitcoin's limited supply and lack of government control make it a viable value of value in times of financial instability. Others counter that its rapid swings make it an unreliable safe haven.

- Additionally, Bitcoin's correlation with traditional markets is still under scrutiny.

- In conclusion, the question of whether Bitcoin can effectively act as a hedge against rising prices stands open.

Battling Rising Prices: Bitcoin as a Solution

As inflation rages, investors are increasingly looking for safe havens. While traditional assets like stocks and bonds have historically devalued during periods of high inflation, Bitcoin presents a compelling opportunity. Its cryptographic nature means it's not subject to the same influence as fiat currencies, which are often printed in excess, worsening inflation.

- Bitcoin's finite nature acts as a built-in defense against inflation, as its value tends to appreciate when fiat currencies depreciate.

- Transactions on the Bitcoin network are secure, making it a trustworthy store of value in an increasingly unstable world.

While Bitcoin's price fluctuates, its long-term potential as an inflation hedge is compelling. By diversifying a portion of your portfolio into Bitcoin, you can potentially mitigate the impact of inflation and grow your wealth over time.

Bitcoin's Response to Inflation

Inflation has surged a major concern globally, eroding the purchasing power of standard currencies. In this situation, many investors are turning to alternative assets like copyright, with Bitcoin oftenpositioned as a potential store of value. The question persists: Can Bitcoin truly mitigate the effects of inflation?

- copyright's decentralized nature and limited supply make it appealing to investors looking to maintain their wealth against inflationary pressures.

- Despite this, Bitcoin's price is {still highly volatile|, influenced by a variety of factors, and its long-term performance as an inflation hedge remains to be seen.

A comprehensive analysis of Bitcoin's history, market dynamics, and underlying mechanisms is essential to evaluate its potential role in navigating inflationary periods.

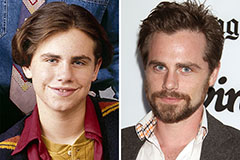

Rider Strong Then & Now!

Rider Strong Then & Now! Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now!